FOCUS: BRAND VOICE CONFUSION | AUDIENCE: EXPERTS WITH IGNORED BRANDS

BY: SHOBHA PONNAPPA | BRAND BREAKTHROUGH STRATEGIST | 45 YEARS | 125+ CLIENTS

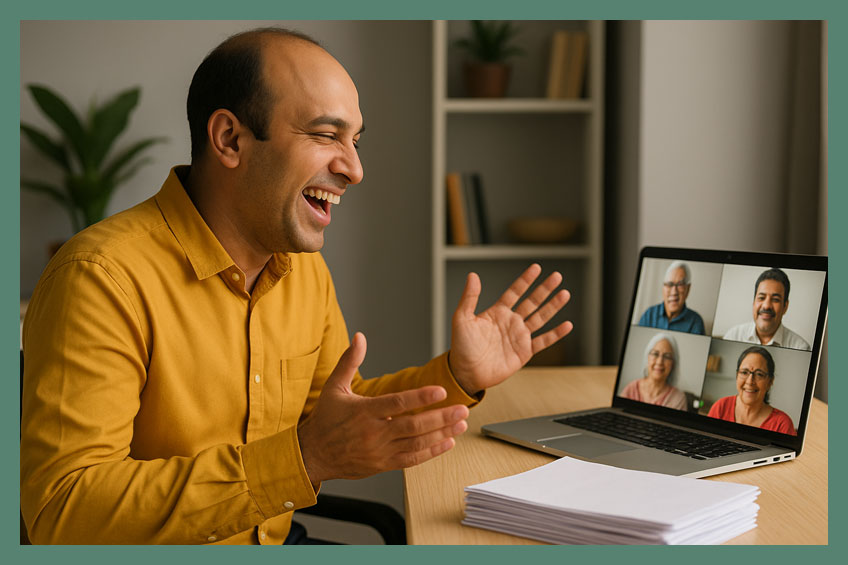

I helped a life insurance advisor shift from gimmicky humour to grounded clarity … so people started trusting him.

A young Indian life insurance advisor was struggling to make headway online. Despite his IRDAI certification and sincere belief in term policies as essential security, his content barely converted. He was liked, followed … and completely ignored when it came to signing up. His approach? Use humour to avoid heaviness. His Instagram was a carousel of punchlines like: “Don’t leave your family guessing … this isn’t Kaun Banega Crorepati.”

They were somewhat witty. They got some laughs. But they also made people treat insurance like a meme. When the time came to act, they didn’t. The tone, while trying to be entertaining, trivialised the product … and turned a trust-driven decision into a throwaway scroll.

When I studied the metrics, the problem became clear: his humour was getting some attention, but not traction. Reels were shared, DMs were full of “lol”s, but consultation bookings remained stagnant. He had become a category clown … visible but untrusted.

What he’d intended as disarming had become disqualifying. In a category where people grapple with mortality, legacy, and financial protection, the tone has to hold emotional weight. Jokes don’t land when the stakes are life and death. He wasn’t being ignored because he was invisible. He was being ignored because he wasn’t taken seriously.

I repositioned his voice with a simple but powerful shift: from comic relief to quiet relief. Instead of deflecting discomfort with gags, he could lean into clarity and calmness. I rebuilt his identity around the line: “I help families quietly prepare for what they hope never happens.”

It became the foundation of everything … his profile bio, site headline, content tone, and even his in-person pitch. Humour didn’t vanish entirely … but it took a back seat to clarity, compassion, and cultural respect. We kept his personality, but gave it gravity.

The new direction focused on three principles: empathy, directness, and story-first content. We shifted the visual identity to be softer and cleaner. Language became crisp, real, and situational. The new headline on his website read: “Life doesn’t come with guarantees. But your family can.”

We built a content engine around real-life situations: “If you’re 33 with a young child” … “If your parents depend on your salary” … “If you’ve just taken a home loan.” No more punchlines. Only relatable, human truths. The shift didn’t dull his brand … it gave it weight.

Here are 10 strategic ideas developed (and several executed) to support the new brand direction:

“If You’re…” series: Short explainer videos tailored to life stages … age 28, new parent, newly married, etc.

Real-life scenarios: Carousel posts narrating actual client fears and how insurance brought them peace.

“What if…” questions as ad copy hooks: Simple prompts like “What if something happened tomorrow?”

Testimonial reels with real clients sharing why they finally bought insurance … and what held them back.

Long-form blog content built around emotional clarity, such as “Explaining term insurance to your spouse.”

PDF guides for first-time buyers written in simple Hindi and English, focusing on clarity and need.

WhatsApp campaign for silent readers with digestible 1-minute stories sent weekly as nudges.

Email series called “Moments You’re Not Ready For” with soft triggers tied to birthdays, EMIs, school admissions.

LinkedIn voice posts sharing how he handled tough client conversations … quiet authority, not theatre.

Instagram grid redesign featuring soft tones, gentle language, and fewer emojis … trust-first visuals.

Consultation bookings increased by 230%, especially from mid-career professionals aged 30–45.

Drop-off from policy quote pages reduced by half, indicating better user confidence.

DMs shifted from jokes to questions, including pricing, coverage options, and trust concerns.

Featured by a regional insurance aggregator, citing his “straightforward and real” voice in a noisy space.

CONFIDENTIALITY CAVEAT: This case study represents a confidential engagement. For privacy, specific brand identifiers, campaign names, and project phases have been withheld. It has been shared with permission while preserving client discretion.

If you’re brand owner or manager seeking stronger brand performance, here’s a case study that could interest you: “How a Clean Air Brand Faded … Until It Breathed New Meaning.“

If you’re an investor seeking momentum for your portfolio brands, this case study I worked on may resonate: “How a Bridge to Global Careers Was Built Too High to Cross.“

"One BIG IDEA can turn brand stagnation into unstoppable movement. Spots are limited each week ... book your breakthrough session now."

Shobha Ponnappa

More Breakthrough Ideas … Case Studies & FAQs … from the Brand Voice Confusion Category

Case Studies

FAQ Insights

Smart insights, real-world frameworks, and idea-driven clarity – designed to help brands move.

Get my fortnightly Brand Reframe newsletter. Smart insights, distilled thinking, and focused momentum to help your brand lead.

Get my free AI strategy guide. Smart prompts, sharper briefs, and practical ways to make AI support your brand momentum.

Just fill in the form to join. Get my newsletter and the guide shown alongside, all with several game-changing tips.